Medicare Part D is a voluntary outpatient prescription drug benefit for people with Medicare, provided through private plans approved by the federal government. Beneficiaries can choose to enroll in either a stand-alone prescription drug plan (PDP) to supplement traditional Medicare or a Medicare Advantage prescription drug plan (MA-PD), mainly HMOs and PPOs, that cover all Medicare benefits including drugs.

The 2020 Part D Standard Benefit

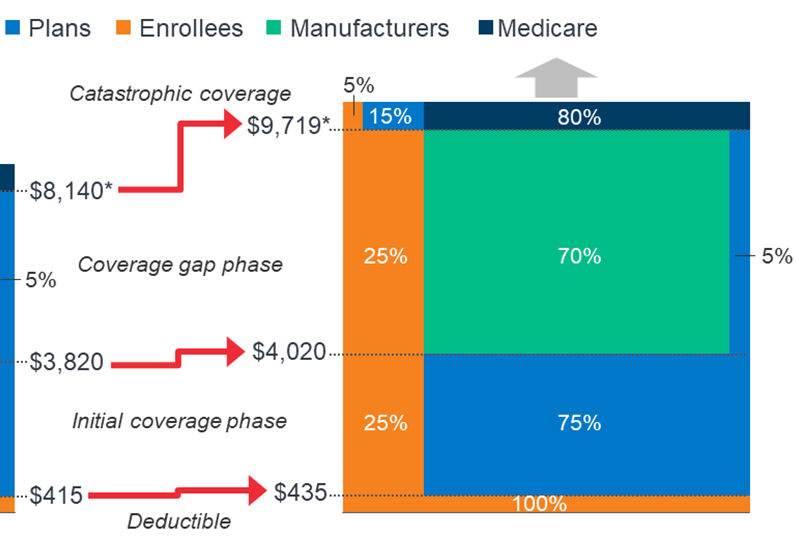

In 2020, plans will pay a smaller portion of the Total Drug Costs up to the Catastrophic Threshold (32% vs 35% in 2019) due to expiration of the ACA’s provision constraining growth in out of pocket costs by slowing the growth rate in the Catastrophic phase. Beneficiaries migrate out of the Coverage gap phase and into Catastrophic coverage phase based on calculated True Out of Pocket (TrOOP) costs. Also, in 2020 Beneficiaries will pay more in out of pocket costs to meet Deductible and Initial Coverage phase thresholds.

See more by viewing the graphic below.

Part D Subsidies

Low Income Cost Share (LICS) Cost Sharing Subsidy

With the Low Income Cost Share (LIS) Cost Sharing Subsidy, plans receive the difference between what a non-LIS member would have paid and the amount the LIS beneficiary was truly charged at point of sale. They will also receive prospective monthly payments (this does not apply to EGWPs) and these are Trued-Up at reconciliation. The subsidy increases as total drug costs go up but is inter-dependent on where the beneficiary is in the phase of coverage.

Coverage Gap Discount Program

The Coverage Gap Discount Program has recently increased from 50% for 2011-2018 to 70% in 2019 and forward (“closed the donut hole”). In 2020, Drug Manufacturer pays 70% of costs (minus dispensing/administration fee) of brand name drugs within the Coverage Gap (“donut hole”). For EGWPs (and including model insulins, for plans opting into the new model, in 2021) this is calculated as 70% of total cost. Otherwise, the discount is calculated as 70% of the copay. This does not apply to LIS members.

Manufacturer payments typically increase as the population’s total drug costs go up but will stop for an individual beneficiary once Catastrophic Coverage phase is reached. Payments to Plans are made quarterly based on CMS-led invoicing to manufacturers.

Reinsurance Subsidy

For the reinsurance subsidy, plans receive 80% of catastrophic claims cost (after removal of associated rebates). Plans receive prospective payments monthly which are reconciled (trued-up) annually. The prospective payments to EGWPs are based on the national average and are not calculated on the plan’s experience. Payments increase as total drug costs go up, but are very inter-dependent on the coverage the plan offers within the Coverage Gap.

Risk Sharing Corridor

CMS sets a target (direct subsidy payments received + beneficiary premiums related to the standardized bid), adjusted to remove the effect of administrative costs. CMS subsidizes half of plan costs that exceed target by 5%-10% and subsidizes 80% of plan costs that exceed target by more than 10%. If plan costs come in less than target, CMS claws monies back according to the same formula described above.

Plan costs are CPP (what a defined standard plan would have paid) minus reinsurance subsidy minus DIR (rebates and price concessions), with the result adjusted by a factor designed to adjust utilization to the defined standard level. Plans that offer richer benefits would expect to see more claims than plans with less-rich benefits. Beneficiaries move into the Coverage Gap when they have met the threshold, based on calculated total drug cost.

The connection to Plan and Subsidies is resulting in having high plan costs and collecting big rebates on the back end will move beneficiaries into the Coverage Gap more quickly than lower costs and lower rebates. However, beneficiaries move out of the Coverage Gap based on TrOOP and so plan design is also a factor in how fast this migration occurs.

Plans may see most of their subsidy per dollar spent, either while its enrollees are in Coverage Gap or in Catastrophic phase. The more rebates a plan gets, the more likely it is that its enrollees will move quickly out of the Coverage Gap. But a Plan in this situation will see less subsidy from Reinsurance. Plans must decide how to analyze the upfront costs of their benefit program against the potential subsidies to be gained, calculating the cost-benefit ratio against the time-value of the premiums collected to the prospective and tailed federal subsidies.

Leave A Comment